Readers often ask: How long do you really need to hang onto your tax documents, and how do you keep them organized?

I come to you today from the rubble of a state tax audit (cue the scary music). I may be worse for wear, but we thankfully emerged unscathed with no adjustments. My CPA and I did a (very mild-mannered) victory dance when we received the final decision.

Before I black this unpleasant months-long experience out of my mind forever, I want to share some CPA-approved lessons I learned.

What I Learned From My Tax Audit

Digitize everything. You don’t need to hang onto physical copies, and in fact digital versions are preferable because receipts fade with time. The decluttering fairy is pleased with this news.

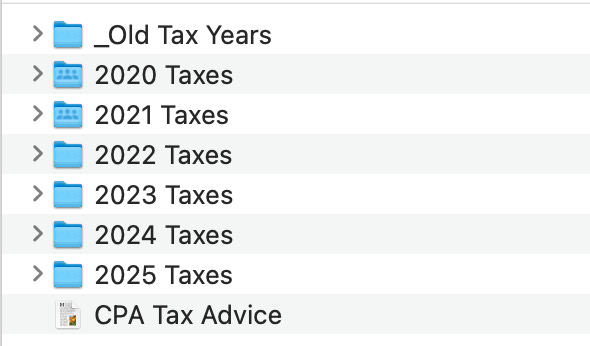

I use Dropbox* to store all my files in the cloud. The Dropbox app has a “scanner” function that turns your phone’s camera into a surprisingly great document scanner. I drop everything into folders organized by year.

Audits typically will only look 3 years back, but be sure to keep records for 7 years (and sometimes longer—see below). Since I digitize my files, there’s no real downside to just keeping records forever. My tax files go back almost 20 years now.

Audits are a documentation game. Auditors are counting on you not being able to back up your numbers with documents. Here’s where being organized can seriously pay off!

Real estate and similar assets can “last” much longer than 7 years, so keep records for the full life of the asset plus a few years. For example, if you own a house for 30 years and then sell it, you’ll need to have records of the capital improvements you made along the way.

Take photos of improvements you make to a home. It’s helpful to be able to show an auditor how you transformed a place, along with the receipts. Turns out auditors love to see your big reveal before/after photos.

Bank and credit card companies are required to save statements going back 5 years, so you don’t need to hang onto them yourself. You can just call and they’ll mail you what you need if you’re audited. This was a huge relief for me.

For all that’s holy, use a CPA to do your taxes! TurboTax doesn’t count. Unless you have the simplest ever tax situation (single with W-2 income, no real estate, no assets) I can’t think of a better investment you could make than a good CPA. They pay for themselves handily in tax savings, and if you ever get audited, believe me—BELIEVE ME—you want a CPA to go to bat for you.

How I Save Documents with Minimal Effort

For ongoing documentation, here’s my system. This should work for many tax situations, like if you’re tracking real estate or self-employment expenses:

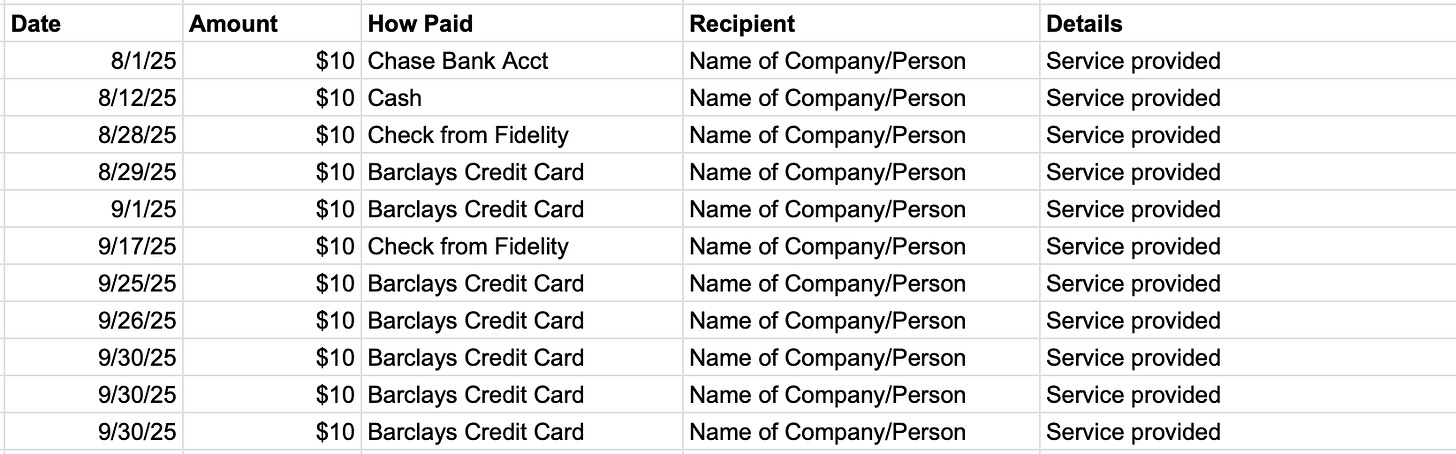

I have a Google Spreadsheet (Excel would also work) where I jot down major expenses related to real estate (in my case), with a tab for each property. I write down the service performed, date, service provider’s name, amount, and payment method (because audits can require provide proof of payment). Keep a shortcut to this file in your browser or desktop so you can easily find it.

I use Gmail for email which lets me easily search for receipts. I don’t bother to file those unless they’re an enormous expense, and having the spreadsheet lets me know what to search for.

Physical receipts get photographed annually and filed in my Dropbox folder under the relevant year. I have a special drawer in the kitchen where I stick tax-related things throughout the year and then scan them in at tax time.

When you gather documents for your taxes each year, you can spiff up your organization. Scan/photograph any physical tax documents you receive and put into your Dropbox folder. You can then just give your CPA a link to the folder.

Here's a dummy spreadsheet to give you the idea of my system — it’s nothing fancy:

Key Takeaways

Documentation can save you tons of money later. My system is a combination of filing things and documenting where to find things. I hope none of you ever get audited, but if you do, future you will be grateful. And maybe you can relax a little bit in the meantime knowing you’re covered.

Share This Important Info

If you know someone who would benefit from this information, please forward this email or click below. My newsletters are paywalled after 2 weeks but are open to all until then.

* This is my personal Dropbox referral link, which gives you a little extra free storage space. I’m not sponsored by or affiliated with them, I just love Dropbox and have used them forever. You can also use Google Drive or some other app of course, just make sure it’s reputable.

Wonderful advice!!